Questions you usually have when traveling

How often, as soon as you landed overseas, did you search for the first ATM or the first exchange office you could find in the airport to withdraw or change your money into the local currency? However, once you saw the fees and the commissions you sadly noticed that you forgot about them when you calculated your traveling budget back home…

Have you ever wondered how much money you loose with the currency conversion when paying overseas or online in different currencies?

Why having this struggle when there is another way? What if we told you that we have been through all these questions? And that we found the solution to get rid of all this hustle? Get ready to hear more about Revolut, because this is the answer.

Invest the next 5 minutes of your life in reading this article. In other words, it may change the way you manage your money when you travel, or even the way you spend them online when dealing with foreign currencies.

Our Revolut Story

First, you should know that this blog post contains affiliate links. We may earn a small commission to fund our coffee drinking addiction if you use the links in our article to make a purchase. However, you will not be charged extra, and you’ll keep us supplied in caffeine.

You should already know that we only recommend stuff we personally tried and love. And we always have our readers’ best interest at heart.

The answer to our questions

Going back to the story. We have been using the Revolut card and services since September 2018 in all our international payments and all our overseas trips. We even use it for domestic payments because it has a ton of advantages.

Revolut solves some existing problems for all the users who make payments and transactions in other currencies than their national / home-based one.

Let’s take us for example. Romania has its own national currency, the Romanian Leu (RON). Therefore, most of the time we book a flight, or reserve accommodation on booking.com or Airbnb.com, or make an international online purchase on Amazon or AliExpress or whatsoever, we pay the price in USD or EUR and we lose a lot of money from the currency conversion fees.

Here is one practical example we experienced.

Last time we used our card overseas was on August 27, 2018. Our card is issued by one of our home banks. At that time, our bank charged us with an exchange rate of 1 EUR = 4.8045 RON. This was by 3.5% higher than Revolut’s exchange rate of 1 EUR = 4.6416 RON. If we multiplied by 1.000 we would see that at every 1.000 EUR spent, we would lose 35 EUR only from this bad exchange rate.

In fact, do you know how much does the currency conversion cost you? Or that you pay about 10% more for every online transaction you process?

If you already know this, feel free to skip the chapter (but make sure you do not miss the following ones 🙂 ).

If this is the first time you hear about it and you are curious to find out more, then read carefully and get a closer idea on how things really work in the currency operation market.

Let’s say that you DO NOT own a USD or a EUR card and you travel to Bali. Or maybe you already are a digital nomad based in Bali. For instance, maybe you are British, and your credit card currency is GBP. Or an Australian, and your credit card currency is AUD. Or from anywhere else in this beautiful world.

When you pay using your credit card in Bali, up to 10% of your final costs will be increased.

Where is this coming from?

This is the effect of how standard banks and card issuers (the international brands like Visa, Mastercard, American Express, etc) are transferring the money between themselves. Every transaction between you and the merchant involves the banks and the card issuers. Both the banks and the card issuers get commissions and fees when you purchase via POS or online. This is how they make money. And they make a lot of money. This means that they gain a lot of money from these fees.

If you want to understand exactly how this goes get prepared for the more technical explanation that goes like this:

What should you know as a card holder?

The international payments between the merchants – banks – card issuers are based on the so-called settlement currency. This is a convention that defines which currency these entities use in order to transfer money among them.

The weapon of choice (as a settlement currency) for Visa, Mastercard, American Express are the USD and the EURO.

Long story short, if you were British and you pay for your delicious meal and accommodation in Bali via your standard credit card, you do not pay directly from GBP to Indonesian Rupiah. As an effect, the final amount paid will increase by about 10%.

That is because the payment goes like this:

- Firstly, the GBP amount is converted to USD/EUR (settlement currency);

- Secondly, the USD/EUR amount (settlement currency) is converted to Indonesian Rupiah.

That means that you will end up paying two commissions for both conversions.

Do you see now how the system works?

But don`t worry we got you covered because there is light at the end of the tunnel 🙂

With the Revolut card, you save a lot of money and time right from the start. So, you do not have to worry anymore about these commissions and fees.

How cool is that the currency fees work the same all over the world? Awesome, right? And yes, it is for real.

Let`s tell you more about why we love Revolut and how it became the card we frequently use when we are at home and while we travel.

So…What is Revolut?

Revolut is a financial technology company based in the United Kingdom. Practical, Revolut is a digital alternative to the standard banks.

You have all the banking functionalities managed throughout a mobile application available in IoS and Android.

With Revolut you get high flexibility in managing your money and a bunch of services that will save you a lot of time and money (as you will see in the next chapters).

Revolut started as a start-up in 2015 and is has become the fastest growing FinTech in Europe. Some of Europe’s most well-known investors back Revolut. They have also invested in household names like Facebook, Dropbox, and Skype!

Some figures

Revolut is having by now more than 7 million retail customers and over 100.000 business customers (and growing rapidly). Revolut has 80 billion USD transaction volume (8 billion USD/month). Can you imagine the scale?

Like mentioned above, Revolut is dedicated for personal use and business. The personal accounts have three plans: Standard, Premium, and Metal. Revolut provides physical cards and virtual cards (we will give you some more details later).

How does Revolut work?

When opening your Revolut account, you connect it to your standard banking card (to one or more banking cards).

You transfer your money free of charge from your usual banking account into your Revolut account by a top-up operation. You can do these top-up operations whenever you need.

The minimum required for these transfers is around 10 USD/EUR/GBP (depending on the currency you open your account with). For us, the minimum is 50 RON (the equivalent of 10 GBP).

How we save money with Revolut and you could easily too. Why every traveler should use Revolut.

From the very beginning , we decided and even stated on our blog that we will share with you our experiences. And that our recommendations will things that we tried, tested or use ourselves. To clarify, we want not only to show you cool places in the world, but also to help you save money while traveling (or online shopping) and make the travel experience a pleasant one.

We first heard about Revolut in a financial article. Shortly afterwards, we saw the card at some friends of ours which were already spending significant times overseas. After they explained us how much money they saved with Revolut, we knew that we are are going to apply for a card. In conclusion, that is exactly what we did :).

We started by opening a Standard account. Right before our Australia adventure (December 2018 – January 2019), we upgraded to the Metal plan due to the multiple options and advantages that come with it.

The online app is so easy to use. It has many awesome features that make the product superior to those offered by the standard banks. That is why we think that every traveler or digital nomad should have the app on his mobile.

Here are the features that we love the most and the main reasons why we use Revolut in all our travels and in our everyday life transactions:

Pay online and spend money abroad without paying exchange commissions.

By far, Revolut has the best currency conversion rate if you choose to pay in foreign currencies. Using the Revolut cards, you can spend in over 150 currencies at the interbank exchange rate without paying extra fees and commissions (unlike the standard banks).

We use the Revolut card for paying all our overseas travel expenses (accommodation, flight tickets, car rentals, restaurants, supermarkets, you name it). Moreover, we use the card for online purchases even if we do them at local Romanian merchants.

In this way, we are able to spend abroad at the best and fairest currency exchange rate we could get.

Thanks to our Metal card, we can withdraw local currencies from ATMs worldwide without fees up to 600 EUR/month.

For the Premium plans the limit is 400 EUR/month and for the Standard Plan, 200 EUR/month. Over the withdraw limit, Revolut will set a 2% fee.

Therefore, you do not have to worry about exchanging and taking too much cash with you when traveling. You can easily withdraw some useful amount with the Revolut card any time. For us, this feature was very helpful in Egypt where we needed to carry more cash (Egyptian Pounds) because of the poor POS network. In addition, we withdrew some amounts of AUD while traveling in Australia, Turkish Lira in Turkey, Singapore-Dollar in Singapore, EUR in Cyprus and Portugal.

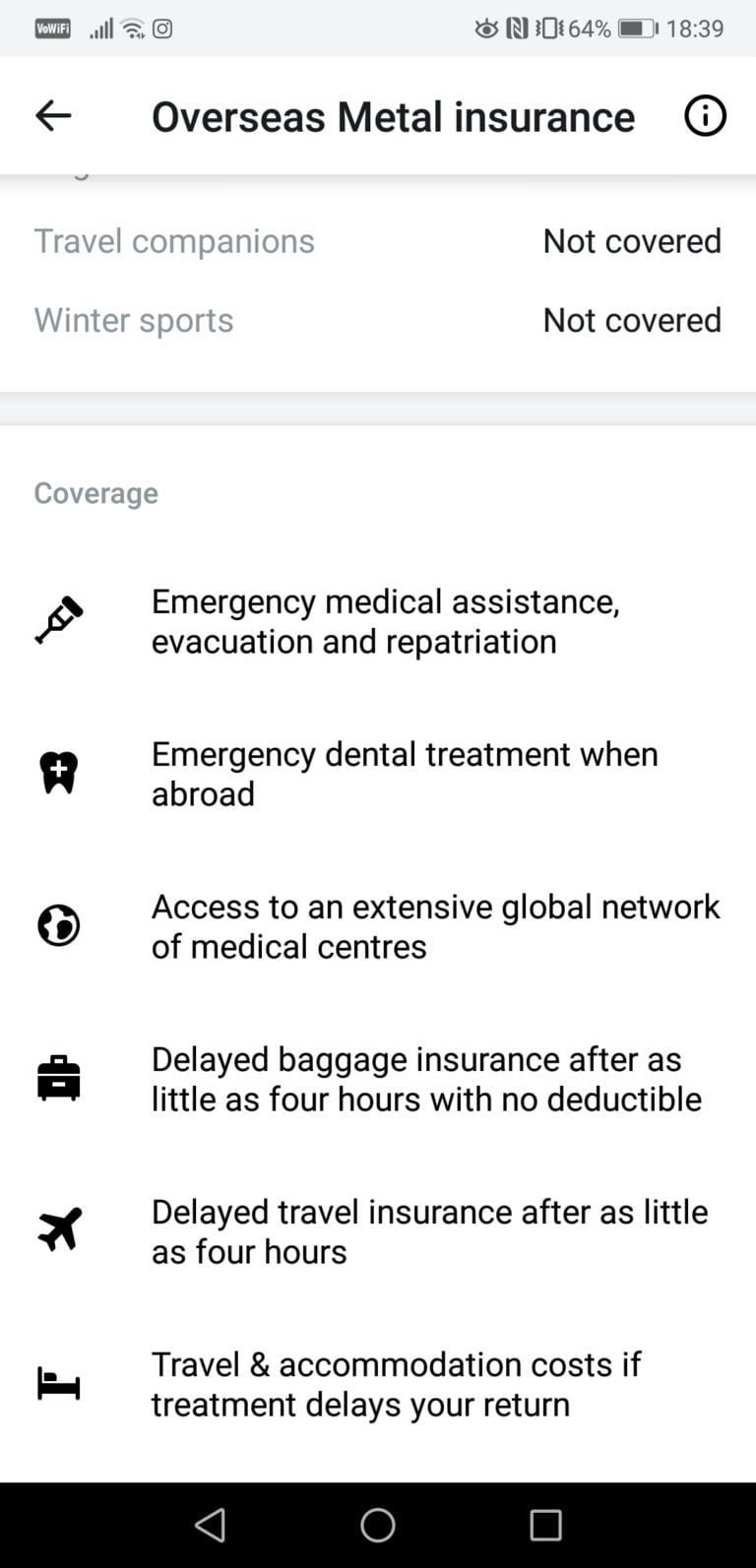

We benefit from free overseas medical assurance, delayed baggage, and delayed flight insurances

The free options are available for the Metal and Premium plans. As for the Standard plan, the cost is around 1 GBP/day.

This saves you from all the trouble in searching for an insurance company and the bureaucracy and the additional costs. If you travel several times a year, our advice is to get the Metal or Premium plan in order to spare money and time.

Our insurance coverage:

- Emergency medical assistance, evacuation, and repatriation;

- Emergency dental treatment when abroad;

- Travel and accommodation costs if the treatment delays your return;

- Access to an extensive global network of medical centers;

- Delayed baggage insurance after as little as 4 hours;

- Delayed travel insurance after as little as 4 hours.

Technology takes care of your travel

Moreover, we do not need to worry about how the insurance works. Technology is taking care of that :). If your mobile’s GPS is activated, Revolut automatically activates the insurance when you leave the country. In the same way, the app deactivates the insurance at your return. How crazy is that? 🙂

With Revolut you can even get insurance for your mobile devices, telephone or laptop. This comes with a certain cost (around 1 USD/week, but you have to check the updated rates). We do not use this option, at least not yet.

We get the security of our money the way we always wanted

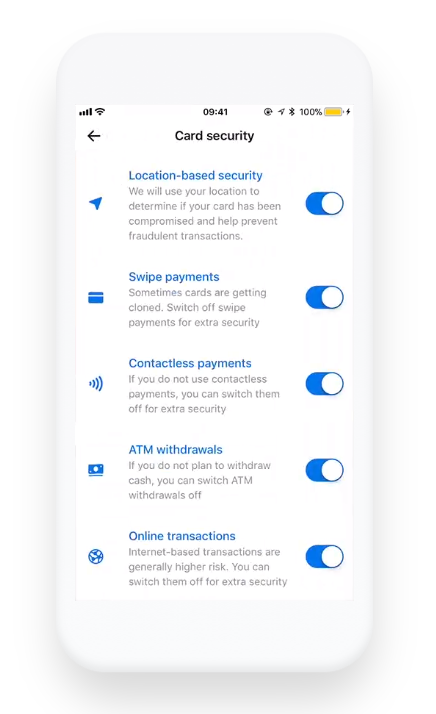

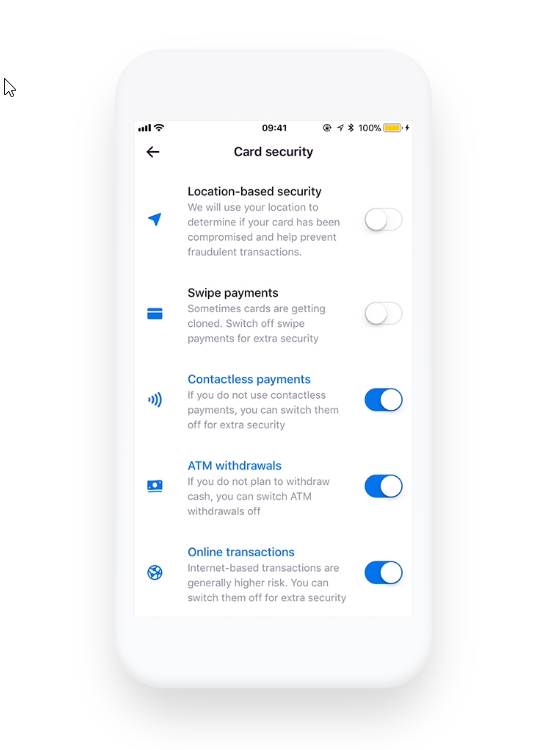

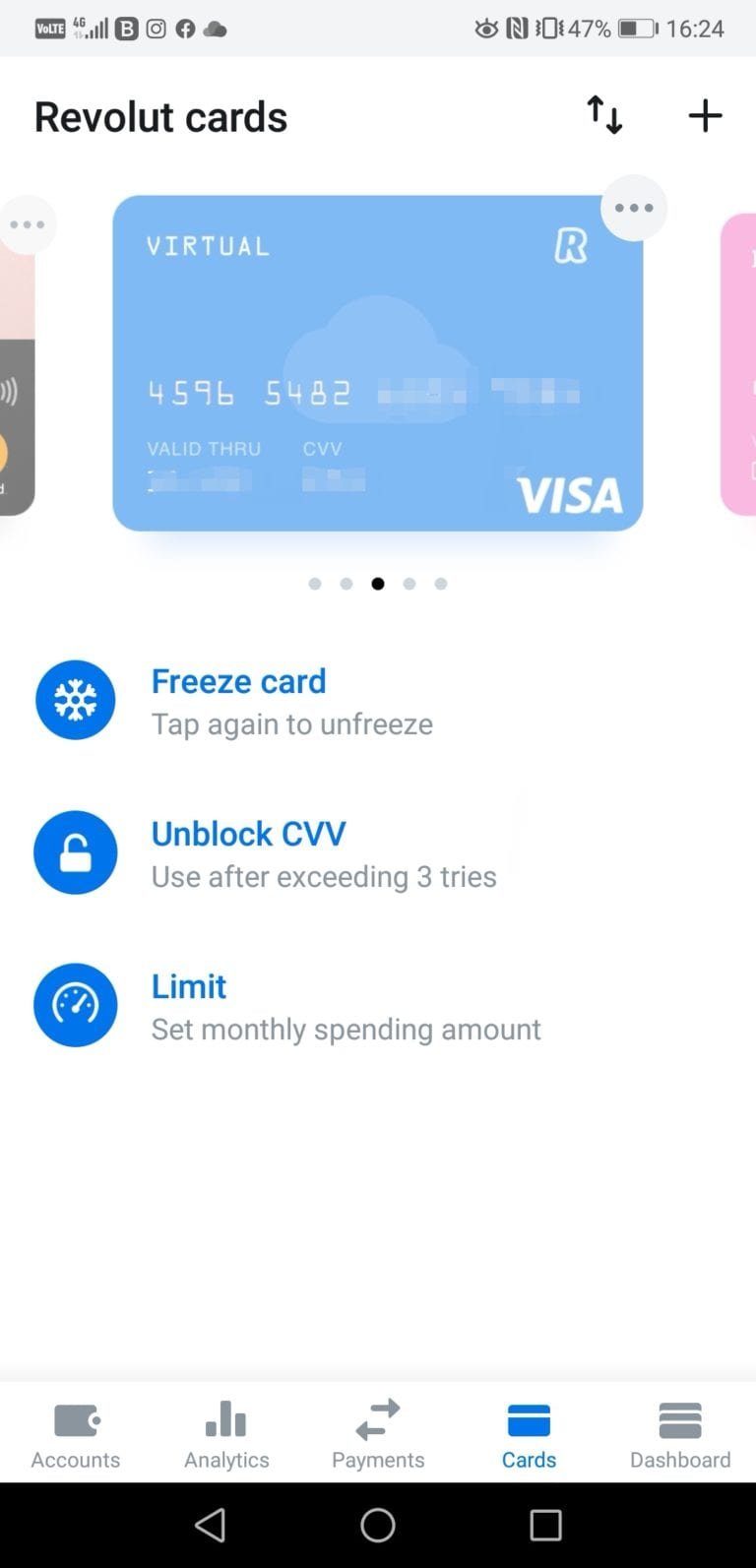

With the Revolut app, we can manage with one-touch how we want to use the card.

That means that for the physical card, we can decide:

– To turn on the location-based security. This means that if our card is used in a different location than the one where we are based, Revolut will automatically block any payments and let us know. We can confirm or block the payment. A mandatory requirement is to have the GPS turned on.

– If we want to enable or disable the swipe and contactless payments, ATM withdrawals, and online transactions for extra security.

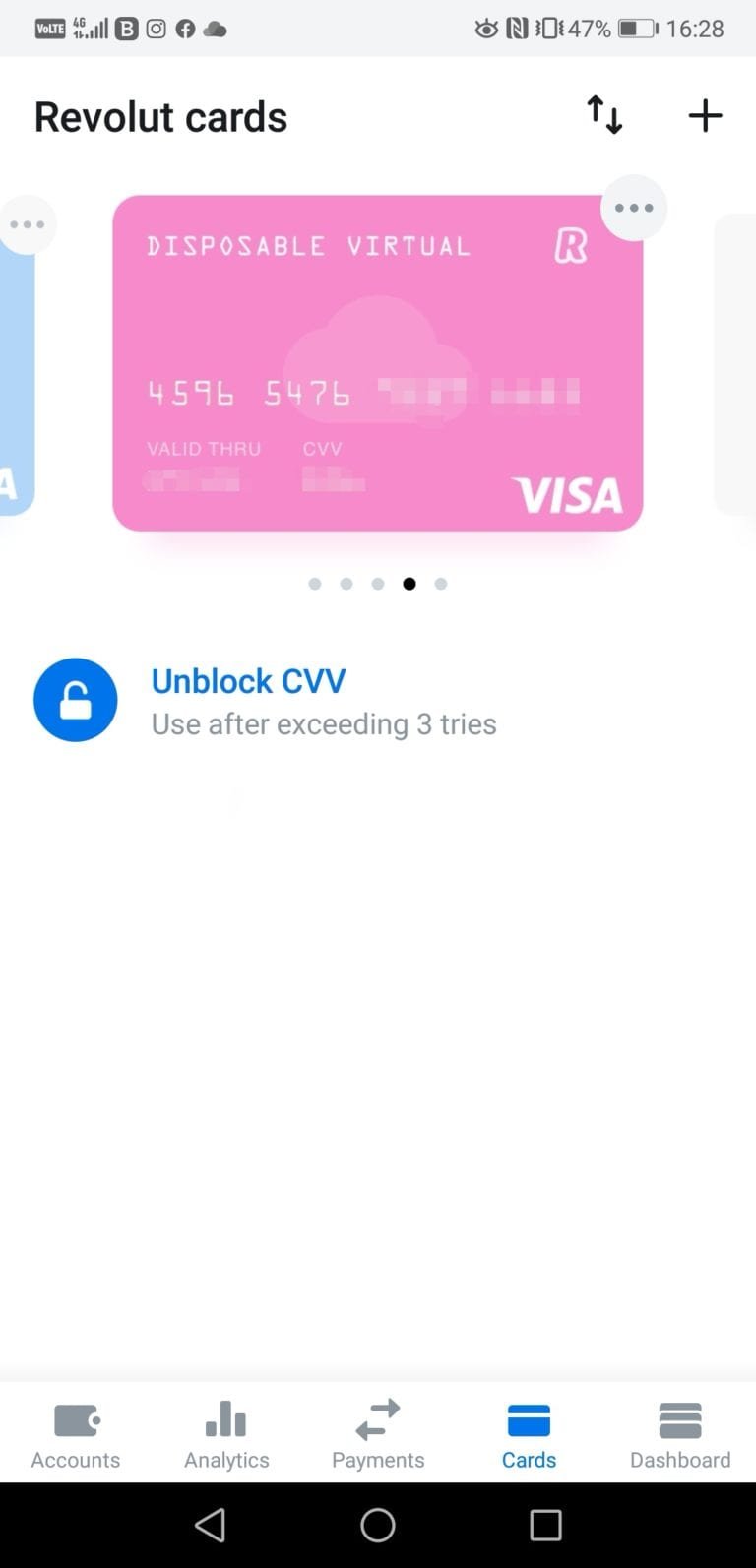

What about the disposable virtual card?

For most of our online payments, we use the disposable virtual card. This is a one of a kind feature offered by Revolut (we are not aware of any standard bank to offer this functionality). The disposable virtual card is available ONLY for the Metal and Premium Plans.

With the disposable virtual card, the security risks are zero due to the fact that you can use it for one transaction only. After we make a payment, the series and the CVC number are automatically changed. So nobody can use our card numbers after that.

Maybe you are now wondering …ok and what happens in case of a refund? The answer is this: the payment will always be connected to our Revolut account (IBAN) and not to the card numbers…so the money is reversed from the merchant’s bank account into our Revolut account. We should mention that by with Revolut you get free EURO and GBP IBAN account.

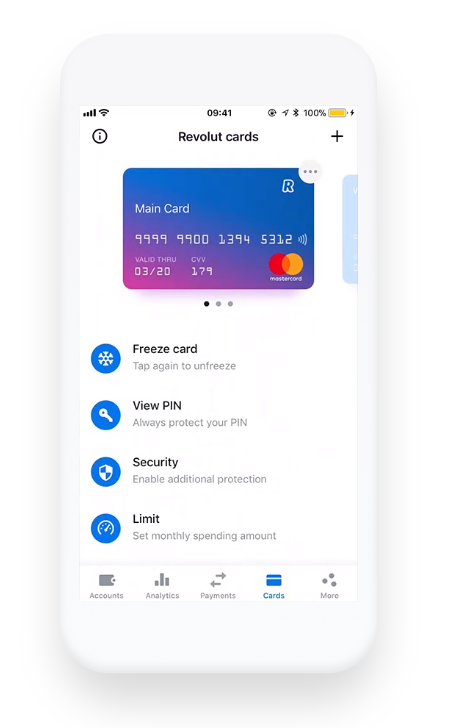

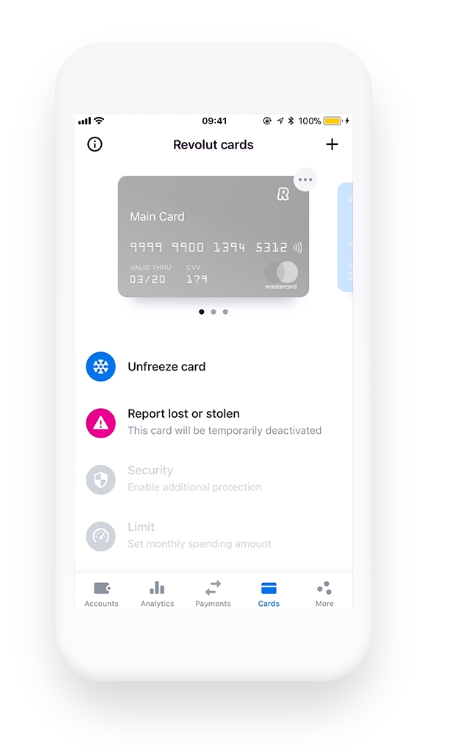

We can freeze and unfreeze our cards in the app with one single touch

If we lose or misplace our card, or if the card is stolen we can freeze it within the app.

If found, we are able to just unfreeze our card also direct from the app. No paperwork, no need to waste time at the bank teller, or on the phone 🙂.

Now let us tell you our experience with this feature. December 2018, on the road to Canberra Australia: We thought we lost one of our Revolut cards and one driving license. The first thing we did was to freeze the Revolut card. However, after a closer search in the car, we found them fell under a sit. The next simple thing that we did was to unfreeze the Revolut card. Imagine the hustle with a standard banking card…getting the card blocked and not being able to use it again even if found. Not to mention the time spent at the phone talking to someone at the bank that can help in these cases.

We absolutely love the Cashback feature we got with Revolut Metal (this option is available only for Metal plans).

We get 1% outside Europe and 0.1% cashback within Europe on all card payments.

It might not seem much, but this is an additional feature that helps you save some money.

The cashback is available instantly as soon as the payment is processed and it is “stored” in your Vault section.

For us, it was a real benefit when paying locally in Australia and Egypt, and for the online purchase done at merchants based in the US.

With our Revolut Metal card, we can easily send and receive money anywhere in the world (like a bank transfer or money transfer) with no monthly limit and without any hidden fees. And you can do this using just telephone numbers.

Revolut users can transfer money worldwide without paying extra fees. They can do the transfers not only to Revolut accounts, but to any bank account whatsoever.

Between the Revolut accounts, the transfer is in seconds. As a result, you can transfer money to a friend by connecting to his mobile number.

How cool is that?

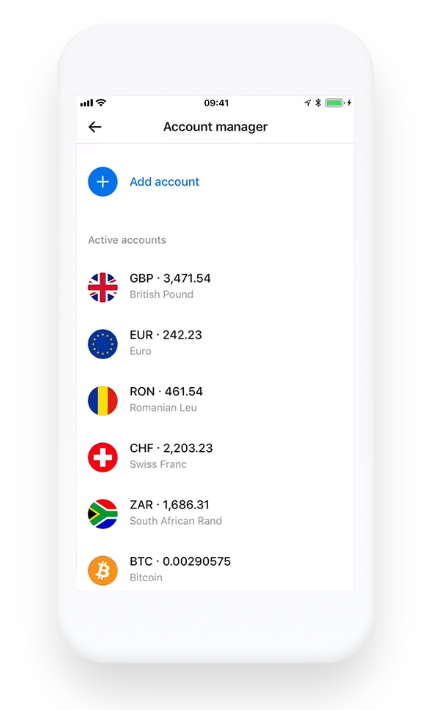

The Revolut card is a multicurrency card.

Which means that you can own at the same time more current accounts in 29 different currencies and still use one card for all of them.

It is awesome, isn’t is? When you think that with a standard bank you need to own separate cards for every currency.

Moreover, with this feature, we can exchange money inside our accounts at the interbank exchange rate, with no monthly limit.

For the Standard plan, there is a limitation of 6.000 GBP/month.

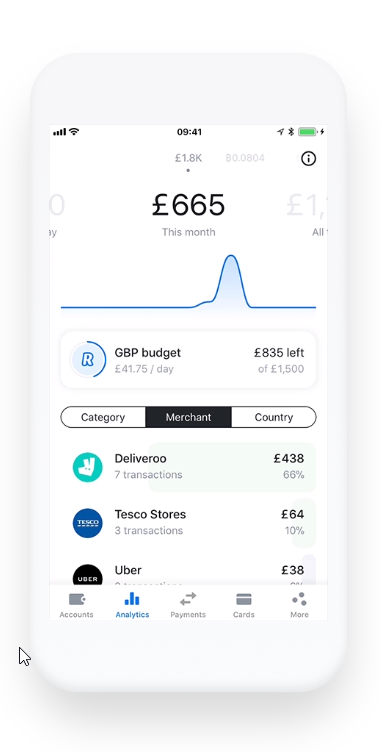

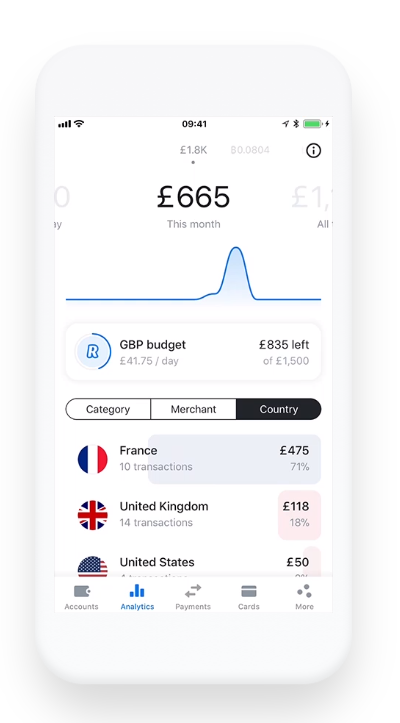

With the app, we can easily track our monthly expenses in the Analytics Section.

If we want to control our budget, we can easily set a monthly spending amount limit. When reaching this limit we are notified by the app.

These options are available for all Revolut users no matter the plan.

In the Analytics section, we are able to monitor our budget better and see our expenses based on the country we spent money in, the category of the products we paid for, or even merchants.

Revolut has become our personal accountant ever since we met :). We do not need to check our bank balance and waste time on splitting the expenses into categories.

A downside of analytics is that so far we do not have the option to extend the analysis period over 1 month.

The customer service is 24/7

We used customer service many times and we are satisfied the way the things work.

You should know that this service is available only in chat version. Not having a telephone line can be a downside if you do not have internet access.

The customer service is available so far only in English.

There are a few other options that we did not use so far but might be interesting for some of you, like:

Exchange cryptocurrency:

If you have broker skills and you want to invest in this market, you have the option to exchange your money into five cryptocurrencies. So far, you can choose from Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple.

You get nice real-time cryptocurrency rate graphs. You can also set up price alerts for when your cryptocurrency hits a certain value.

Trading stocks:

Revolut provides investment services in the stock market at major companies such as Google, Facebook, Amazon, and Tesla.

You can buy and sell these stocks without paying a commission stock trading (as if you would pay for a brokerage company). Our advice is to use this service only if you are confident in your stock trading skills :).

Concierge services (free of charge and available for Metal plans only):

This means that you submit a request and you will be provided with assistance for hotel and restaurant reservations, flight bookings, and special events and so on.

Access to airport lounges worldwide – available for Metal and Premium plans.

Be aware: Metal plans get 1 free lounge pass (1 time). Extra entries for Metal plans and all entries for Premium plan are to be purchased at a price around 25 EUR.

How to sign up for your Revolut account?

If you got to this part, you are already thinking about getting a card, right?

In this case, know that it takes no more than 60 seconds to open your Revolut account.

Yes, you heard us right it is that simple. Now think of all the paperwork and the bureaucracy you avoid.

Just access the link or the image below and you will be redirected to the Revolut site. It is important to tell you that by accessing our links you will get your FREE Revolut card, saving £4.99 postage fees!

If you read this article on your notepad, you will be redirected to this page. You need to enter your mobile phone for Revolut to send you an SMS containing a link for downloading the app.

If you read this article on your mobile you will be redirected to a page where you can directly download the app via the Get the App button.

You need to download the app and start opening your account.

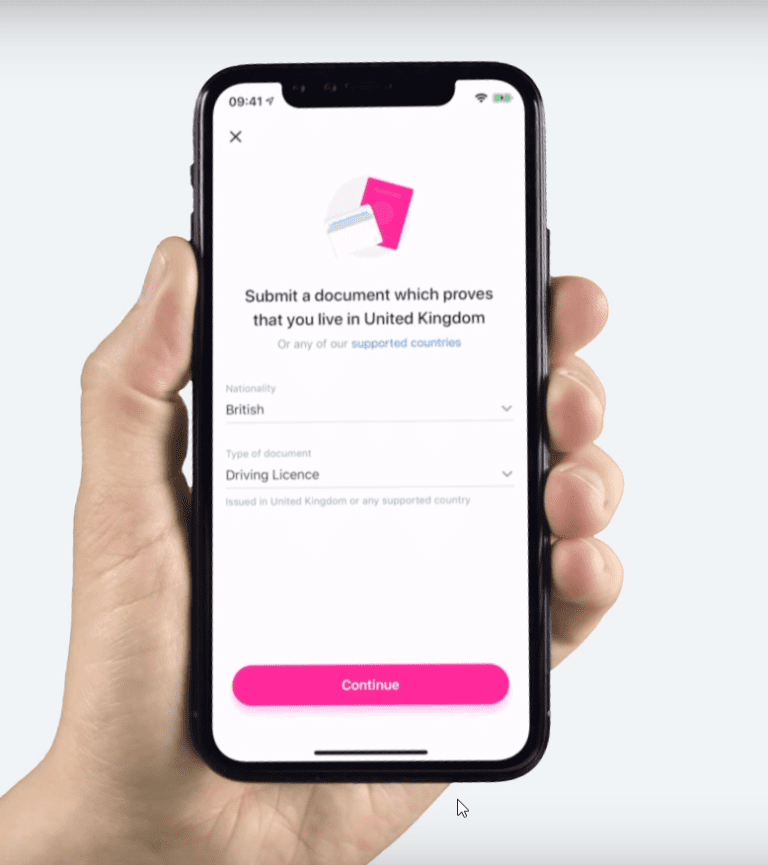

For signing up into Revolut, just go to the following steps:

1. Create a password of 4 digits for your Revolut account

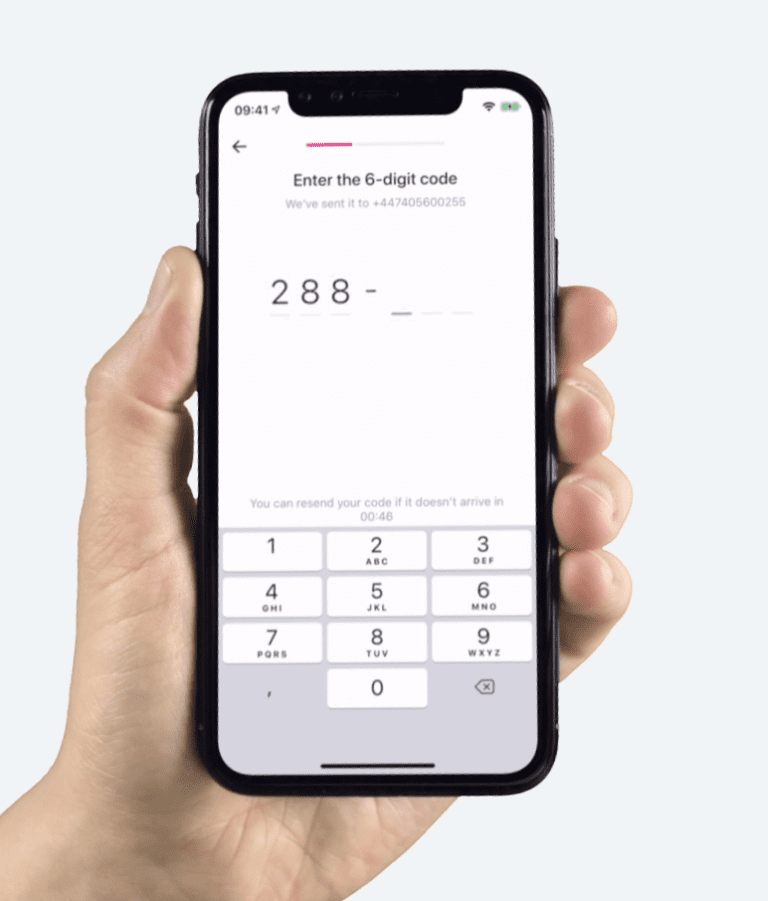

2. You will be given a 6 digit code via SMS you will receive on your phone number

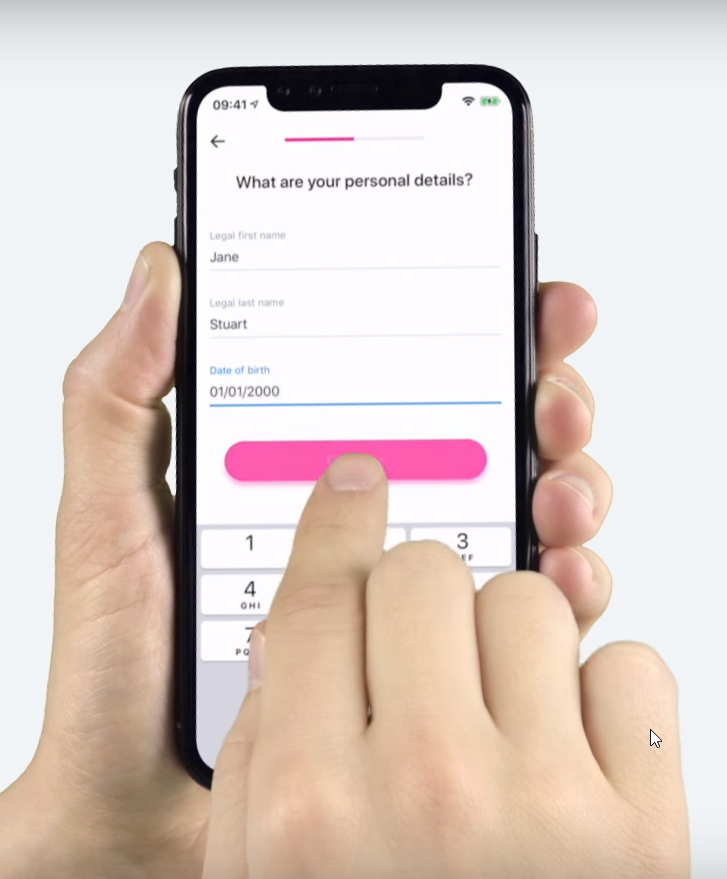

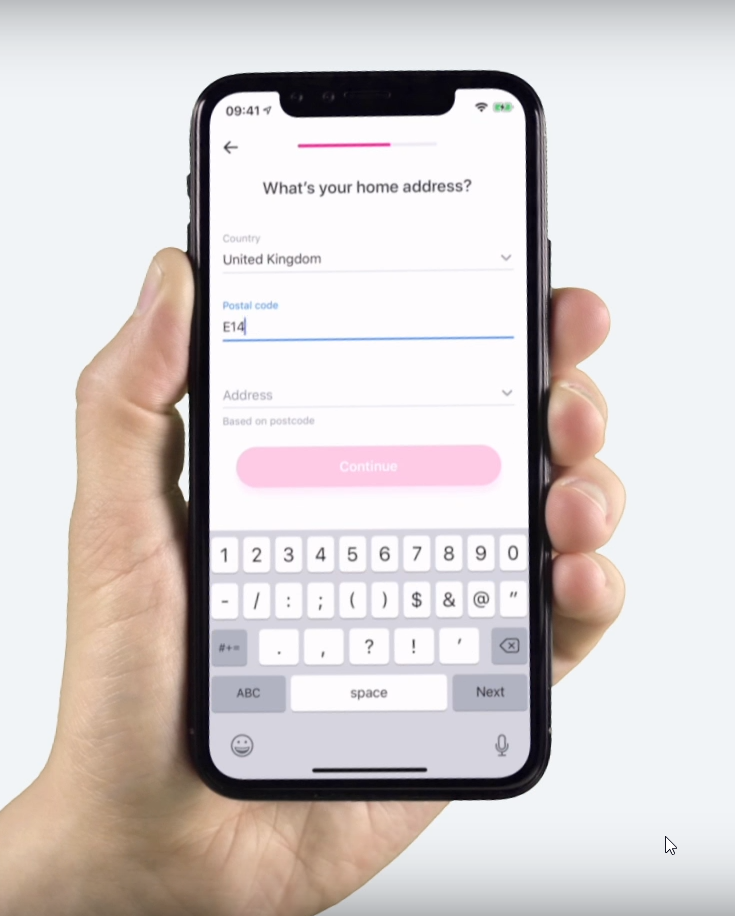

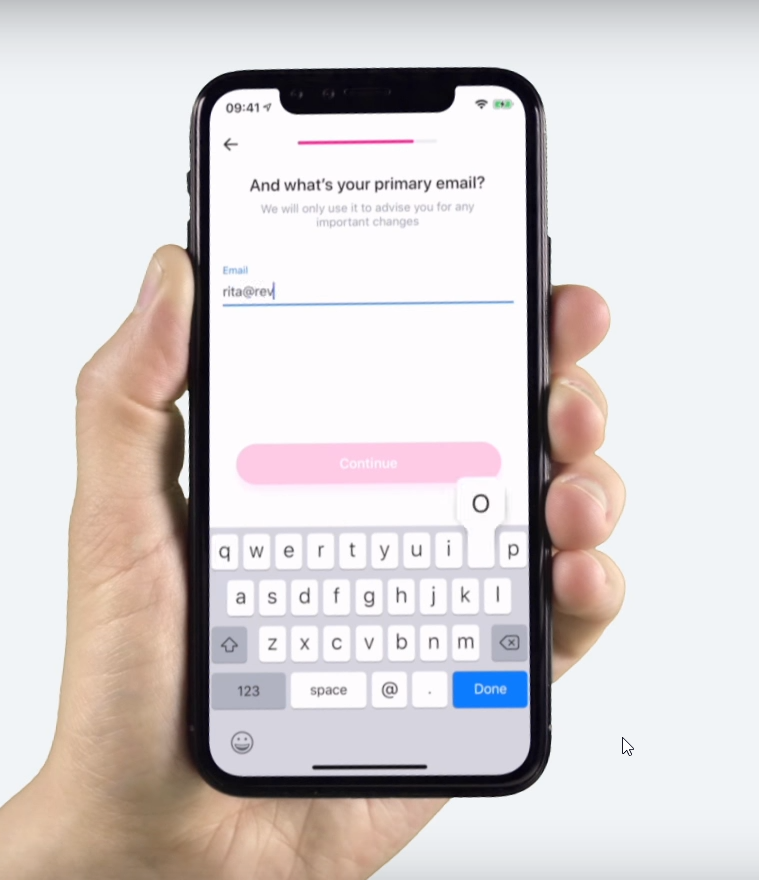

3. Fill in personal information like your name and date of birth, home address and your email

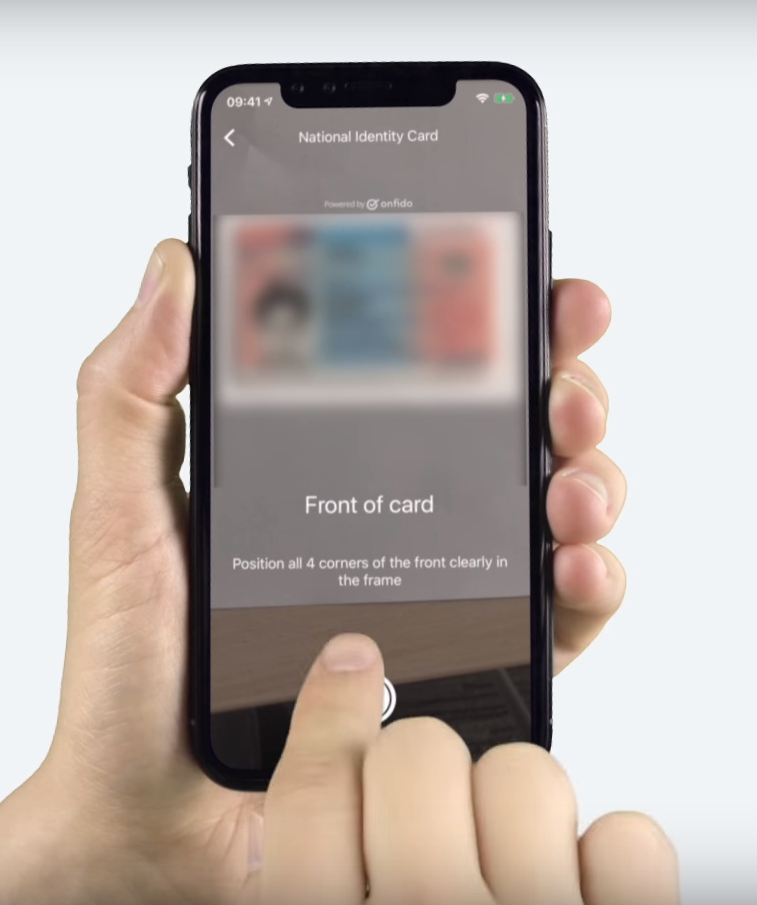

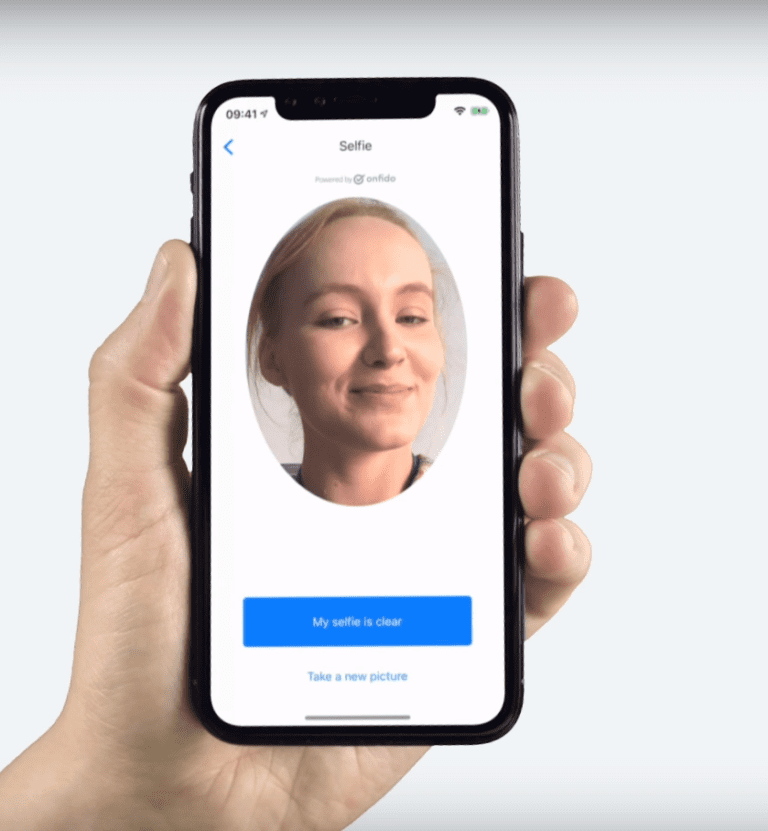

4. You will be required to verify your identity by sending a photo of your ID and a selfie to confirm it.

Asking for ID verification is a common-sense practice. Nevertheless, all the financial organisations are doing it. Because of this procedure, you should feel more secure knowing that all the clients are registered and linked to their IDs.

Technology is helping again…

As information, Revolut is using a backend technology that matches the common points of your face from the photo of your ID and the selfie.

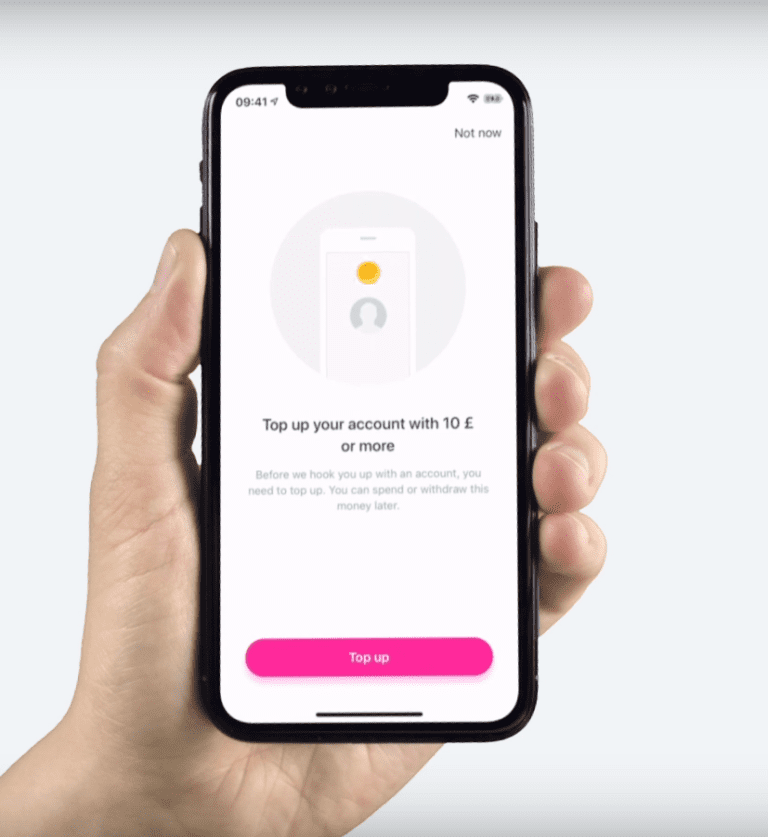

5. In order to start you need to top-up your Revolut account with a minimum amount of 10 GBP/EUR/USD or equivalent in your local currency.

This amount is available in your account as soon as you finished configuring it and will be there for you to spend.

This is it! You got it!

After setting this thing up you can head to cards section and order your physical card that will be drop-shipped by Revolut in few days.

The only thing you need to pay for is the transport fee (this should be around 5 Euro, the cost of an airport coffee :)).

But again, click bellow to get your FREE card!!!

If you wondered…How Revolut is making money… read along

This question popped in our heads too so we researched a little bit.

According to Irina Nicoleta Scarlat Head of Growth – CEE at Revolut, the incomes of the company come from the Premium and Metal memberships, the commissions paid by the merchants to the card’s issuer, Visa or Mastercard.

If you do apply for a Revolut card we are so curious to know your feedback so please let us know in the comments below, or DM us on Instagram, write us an E-Mail.

If you already have one and use this service, we are happy you were reading this article; this means you are as much of a fan as we are :). We will probably have to meet and share our Revolut journey.

If we can help you in answering any of the questions you might have regarding Revolut and our experience with it, we are more than happy to help.

Whatever you decide we wish you to always make the best choices when it comes to handling your money and may your life be financeproblemsfree :).