Often, we ask ourselves how to save money?

Like we stated many times, money comes with effort and goes so easy. The fact that we managed to avoid PayPal fees and use our Revolut cards for most of the daily transactions is helping us deal with our budget in a smart manner.

Why saving and cutting useless costs is important? Very simple, because with the same money you can have more or better quality. More of traveling traveling, more clothes, more gadgets, better food, or whatever you are passionate about.

And paying inflated PayPal fees are unnecessary costs since there are options to manage your finances smarter.

Before you read any further you should know that some of the links in this post are affiliate. We may earn a small commission if you use the links in our article to make a purchase. You will not be charged extra, and you’ll support us to constantly provide you quality content.

However, this does not influence our reviews or any recommendations we make. You should already know that we only recommend stuff we personally tried, love, and we always have our readers’ best interest at heart. We always try our best to keep things fair and balanced, in order to help you make the best choices for you.

A GUIDE OF HOW TO AVOID PAYPAL FEES – 3 handy options for saving your money

Let us begin with an overview of PayPal. So we could all understand that PayPal will still be in this market for a few years. 😊 And no matter how hard we will try to find alternatives, PayPal will be used on a high scale by the merchants worldwide.

PayPal is the most popular way to send or receive money, or even buy online. It is relatively fast and easy to use, secure, and most of us know it or already have PayPal.

Yet, a big downside of PayPal are the high fees. However, most of us have to use PayPal because it is the biggest online payment provider.

As a result, we began asking ourselves how to avoid PayPal fees? We started analyzing the fees set for all type of PayPal accounts.

While studying, we discovered that these fees are not so transparent as they should be. For example, in the PayPal site, you will have to search on a deeper level to find this information. It is either placed inside some hard to find links, either “hidden” in the terms and conditions section.

As a joke, it probably reminds you, as well, of the documents you receive from the bank. Too many papers. Fees and commissions somewhere on page 4 or 5. By the time you get here, your head already explodes when reading all those law terms. 😊 😊 😊

What you should know if you use PayPal for international payments?

Joke aside, for us, PayPal is not the best option when dealing with international transactions, like sending or receiving money, or buying online.

While PayPal might seem to be highly efficient and easy to use, it actually costs you as much as a standard bank. All because of the different kinds of fees applied by PayPal to any online transaction.

Do you need PayPal after all?

The answer is yes…you need it because PayPal is the biggest online payment provider. We did not give up our PayPal accounts nor do we intend to do it because we found out how to avoid paying some PayPal fees. 😊

Due to its easy integration, PayPal has become one of the most popular options of the merchants when linking their payment gates. In spite of rough competition, a lot of e-commerce companies are using PayPal as a payment method.

In other words, there is a very large number of sellers out there who use PayPal services to collect the money you pay when you shop online.

This means that if you make a buy, you will also have to use a PayPal account of your own.

For example, the biggest marketplaces in the world, such as eBay (eBay owns PayPal) and Amazon, use PayPal as a payment method. And the list could continue. For now, even if you would want to, you cannot give up to your PayPal account.

To get a rough overview, you should know that PayPal is having over 280 million active accounts. As a result, PayPal counts a total payment volume of over 170 billion USD. Imagine how long would it take for you to count all this money? 😊

Our advice to save money

Are the PayPal fees that big? How do the PayPal fees affect you?

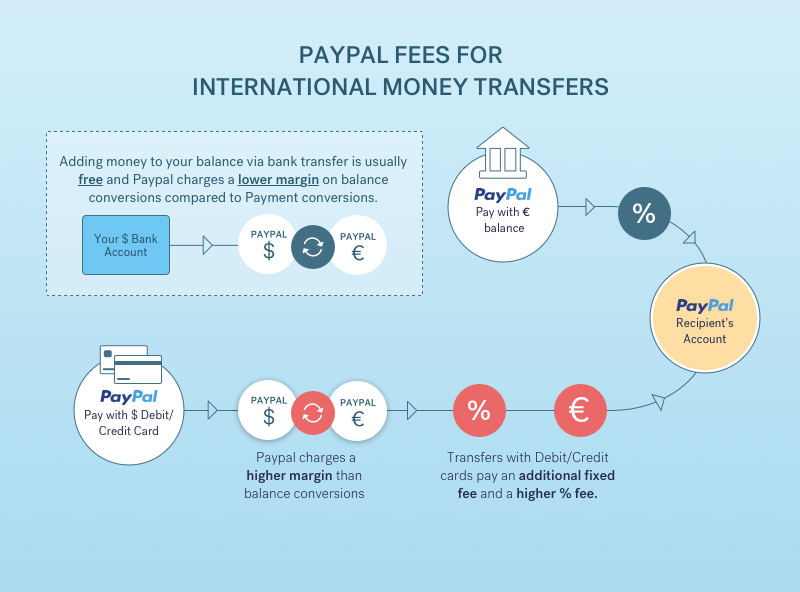

An important volume of PayPal’s huge revenue is coming from the currency exchange fees. This means that if you buy a product in EUR and you pay in USD, PayPal will apply a currency conversion fee.

How does PayPal fees apply to the Currency Exchange rate?

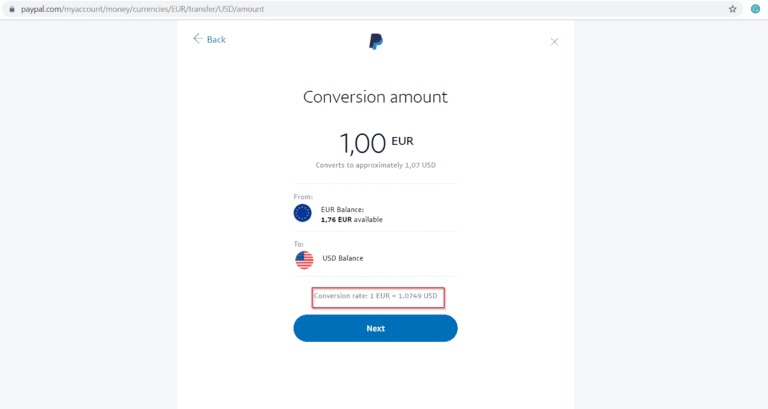

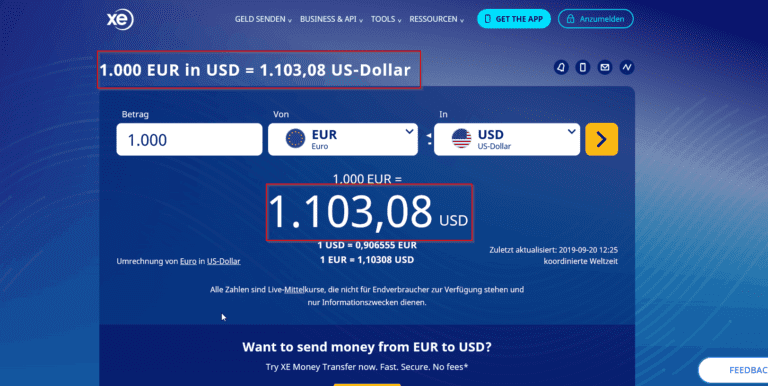

Let us show an example from the 20nd of September 2019.

PayPal will exchange 1 EUR to USD at a rate of 1 EUR = 1.0749 USD. Which means that if you want to exchange 1000 EUR, you will get from PayPal 1074.9 USD.

In the same day at the same time, the currency conversion in the market was 1 EUR = 1.10308 USD. So, for 1000 EUR you will get 1103.08 USD.

In conclusion, for 1000 EUR traded through PayPal, you lose 28.18 USD. This means that you lose 2.6% only from the high exchange rate PayPal is applying to your money.

You can find PayPal’s currency exchange rates by following the steps from this link.

Are there any other PayPal fees?

Yes, there are… 😊 So, PayPal is earning a lot of money by applying fees when you receive or send money via transfers.

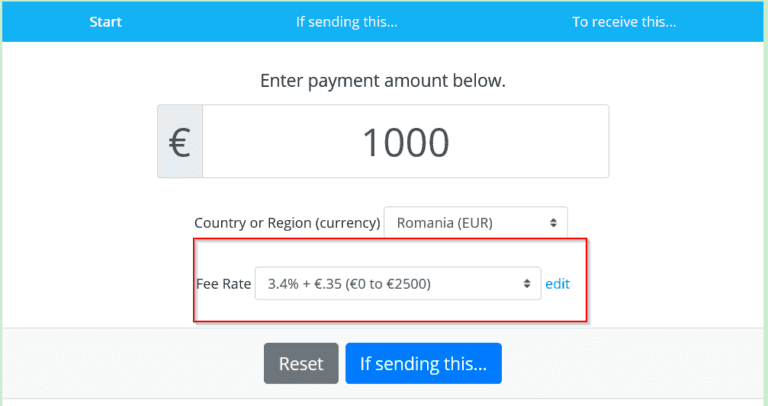

When sending a cross-border Personal Transaction payment, the sender will pay a fee of 3.4% + a fixed fee. You can find all the fees here.

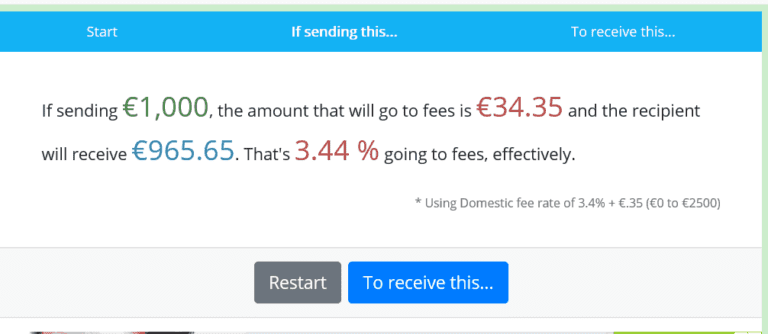

So, what does it mean for us, based in Romania, to send 1000 EUR? It will mean that we will have to pay 3.4% more + a 0.35 EUR fixed fee (this being a transfer between 0 – 2500 EUR).

In conclusion, if I want to send 1000 EUR, my partner will receive only 965.65 EUR because 34.35 EUR will go to PayPal as fees.

Provided my partner needs to receive 1000 EUR, I have to cover from my pocket the extra 34.35 EUR and to send a total of 1034.35 EUR.

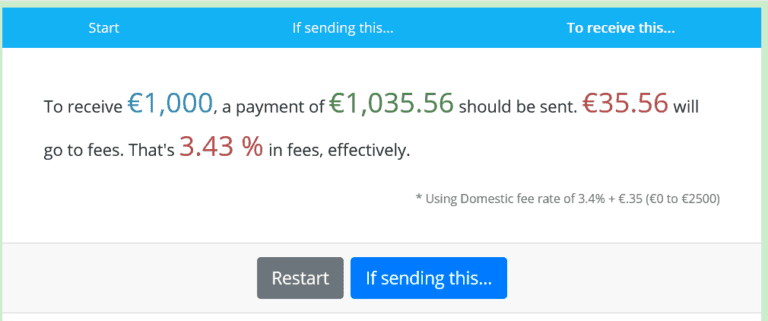

The same thing applies when you should receive money. To receive €1,000, a payment of €1,035.56 should be sent. €35.56 will go to fees. That’s 3.43 % in fees, effectively.

You can calculate your PayPal fees here:

What can you do to avoid the PayPal fees?

By now, you should have learned how much PayPal fees cost and impact you. Also, you are able to estimate the fees of a PayPal transaction by using the online calculators.

But if you reached this point, you definitely are interested in avoiding these extra costs, aren’t you? Thus, we will present you 3 important options we use for saving our money when dealing with PayPal.

Avoid Paypal Fees

1. Use Revolut card as a preferred payment method in PayPal (our number 1 choice for avoiding PayPal fees)

By far, integrating Revolut into PayPal is our favorite method. Because we can still use our PayPal account without being overcharged with additional fees. And we opted for this method because we need the PayPal account.

For example, since 2003, PayPal has been eBay’s main payment provider (after EBay became PayPal’s main shareholder). In addition, throughout the time, we made online buys from companies whose only payment method was PayPal. And we had no alternative to pay but using our PayPal account.

Hence, we had to figure out a way to cut our costs. And by linking our Revolut card and assigned bank account we can pay everything on PayPal without any extra fee.

How is Revolut a reliable help in avoiding the currency conversion fees of PayPal?

How is Revolut a reliable help in avoiding the currency conversion fees of PayPal?

Revolut provides two major advantages when dealing with international currencies, such as:

1. Revolut converts the money at the interbank exchange rate.

In other words, Revolut does not charge you with additional fees when you pay in a different currency. Unlike Revolut, the standard banks and PayPal apply the so-called exchange conversion commissions.

2. The Revolut card is a multi-currency one.

You can easily manage up to 29 currencies accounts linked to the one unique IBAN. For instance, one of our cards has 3 currencies attached: RON, EUR, and USD. And we manage all within one mobile application and one card.

There are many other advantages of owning a Revolut card and you can find them here.

Revolut integration in PayPal – easy, simple, and effective way to avoid PayPal fees

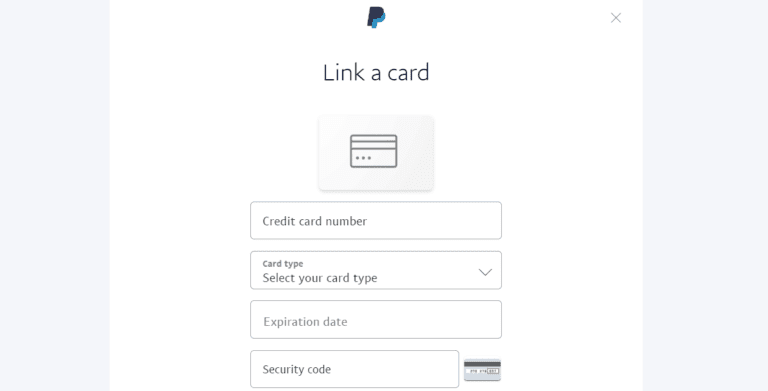

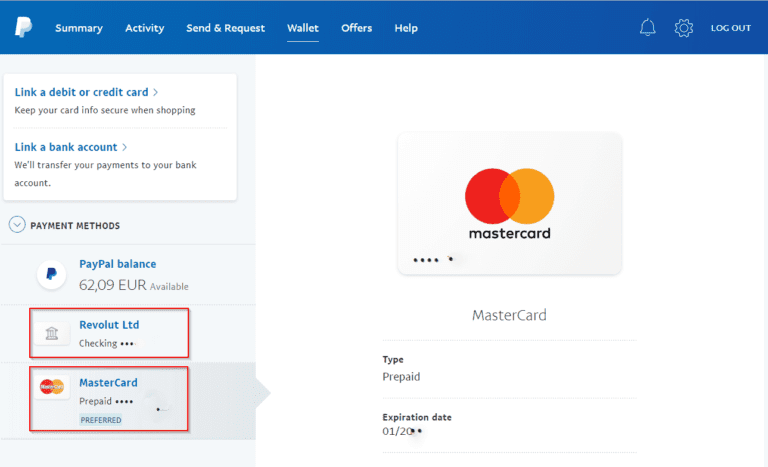

The process is similar to linking any bank account and debit/credit card to your PayPal account. Basically, you just replace your standard bank with Revolut’s free fees advantages.

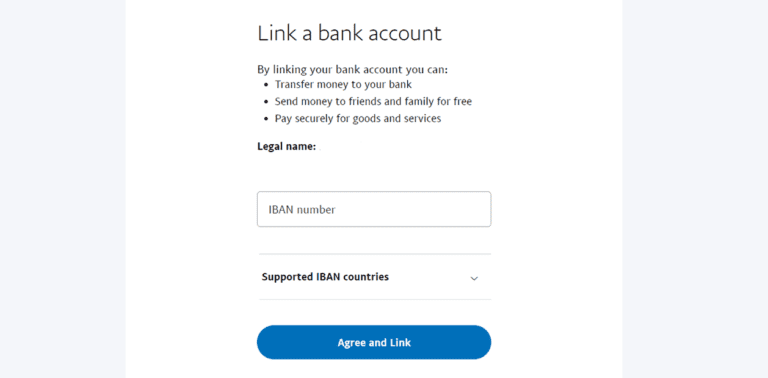

- When you sign in for a Revolut, you will receive a unique IBAN account. The Revolut IBAN is working just like a standard bank account. Also, this is the IBAN account which you will have to link to PayPal in the “Link a bank account” Section.

- You have to link the Revolut card as well in the same manner as you did in the previous step.

- The further step is to choose payment from the Revolut card whenever you make the purchase

And this is all you need. From now on, your transactions will no longer be commissioned with the currency exchange fee. This is one handy way to minimize your costs and to avoid the PayPal fees.

We used this method in our latest acquisition of an online course from our friends from @wanderintwo. After all, Ivana and Jamie were the ones who inspired us in writing this blogpost.

↠ Get your FREE Revolut Card saving £4.99 postage fees! And say bye-bye to the exchange fees.

Avoid Paypal Fees

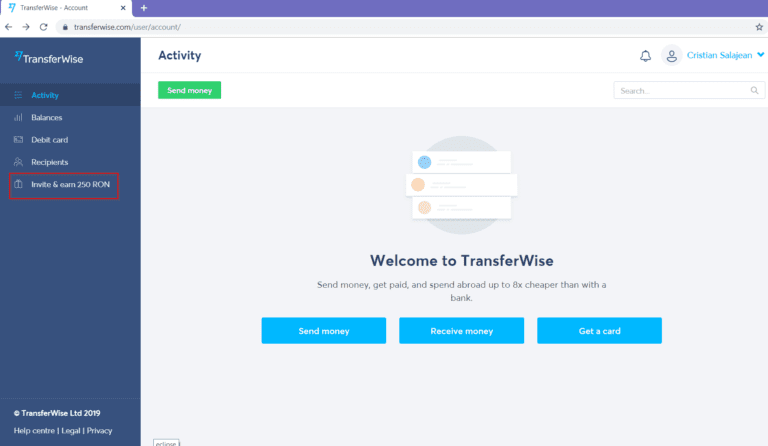

2. Use TransferWise as an alternative to PayPal

Now, if you want to get to the next level, using TransferWise instead of PayPal is one of the best solutions in the market right now.

Basically, TransferWise is an online money transfer service. With TransferWise it is up to 8x cheaper than any traditional bank or PayPal when it comes to international transactions.

We guess this is the reason why over 6 million people already chose to transfer money with TransferWise. When you analyze TransferWise’s financial reports for 2019, you will see that its customers transfer over £4 billion every month.

Moreover, 10,000 new business customers are signing up to the service every month. Pretty impressive, right?

Where is the cheap option coming from and how come such a big volume of transfers?

TransferWise does not charge you with currency exchange fees (Revolut does the same) and has very low transfer commissions.

Unlike other services, the transaction costs are always transparent so you can see exactly how much your financial operation is commissioned.

TransferWise international payments on major routes from the UK and Europe are delivered within 24 hours – compared to 3-7 days for a regular bank or PayPal.

As for safety, TransferWise is fully regulated by the Financial Conduct Authority, just like any other UK bank. This means that TransferWise verifies its users to protect against fraud and money laundering. In the online environment, TransferWise uses high tech to ensure the safety of its clients.

TransferWise accounts and cards – more suitable for money transfers

In our opinion, TransferWise fits better when you have to send your money abroad.

For this reason, we believe that TransferWise is more advantageous in the following situations:

- As an individual, to send money to family, friends, etc.

But as you will see in the upcoming lines, Transfewise provides cards that help you in online shopping as well. - For businesses (freelancers, digital nomads, sole traders, every type of small to large businesses), because it is 19x cheaper than PayPal.

With TransferWise for business one can do the following:

- Pay invoices, buy inventory, and handle payroll with the real exchange rate in over 40 currencies.

- Send money directly from your own debit card or bank, or make payments from your account balance. Your recipient doesn’t need a TransferWise account to receive their money.

- Receive money with zero fees. So, you can use TrasferWise to get paid or withdraw money from platforms like Amazon for free.

- Use your TransferWise Business Mastercard to pay business expenses and spend online or in-store all over the world.

TransferWise has an awesome feature. It is the Borderless account and it is available both for Personal and Business Plans.

So, if you or your business deal with money transfer, cut off some costs and join FOR FREE other 6 million people and businesses in the TransferWise world. 😊

TransferWise’s Borderless account, short overview

In a nutshell, the TransferWise’s Borderless account is an online multi-currency account (just like Revolut). It is ideal for travelers, expats, and freelancers.

In the Borderless account, you can hold your money in more than 40 currencies. Also, you get personal account numbers and bank details for EUR, USD, GBP, AUD & NZD with zero fees for receiving money into these accounts.

Along with account details, you can order a free TransferWise debit Mastercard. You can use it all over the world where Mastercard is accepted. Owning this card, one can benefit from free ATM withdrawals up to £200 per 30 days.

The advantage of the TransferWise debit Mastercard is that as long as you hold your money in a currency of the transaction you do not have to pay a fee. For example, you need to pay a price in USD. Let’s say you own simultaneous accounts in EUR, USD, RON, CHF, etc. The app takes your money from the USD account free of any charge or commission.

But, if you want to convert your money to a different currency, you’ll be commissioned with a single low conversion fee (no transaction fees applied).

The conclusion is that Transferwise (with its borderless account and debit card) is a great money transfer service. In addition, TransferWise has a great invite and Earn Program. You can invite your friends and earn 45 GPB (@50 EUR).

Nevertheless, always analyze the situation you are in and choose the most suitable solution for you. We, for example, have both Revolut and Transferwise accounts.

But for our needs right now, Revolut suits us best. Because our transferring money needs are limited, and we use Revolut card for our payments online and overseas withdrawals. Having the Metal Plan from Revolut, we enjoy a lot more benefits when traveling or spending online.

What happens if you want to keep PayPal as the main hub for your transactions? Can you use TransferWise to avoid the PayPal fees?

In case, you opt for Transferwise as your leading service or you already have an account, you can easily integrate it to PayPal. All you need is to set TransferWise as the preferred payment method.

Just follow the same steps we described above when showing you the Revolut’s assignment to PayPal. Overall, your costs will decrease substantially.

As a recap, you need to:

- Sign in and create a Transferwise account;

- Set up the borderless account and get a TransferWise card;

- Link your borderless banking details in your PayPal’s Wallet -> Link a bank account.

Avoid Paypal Fees

3. If you do not have Revolut or TransferWise (YET)… Here is something you can do within PayPal to reduce your fees

Here are some other options to minimize your PayPal costs:

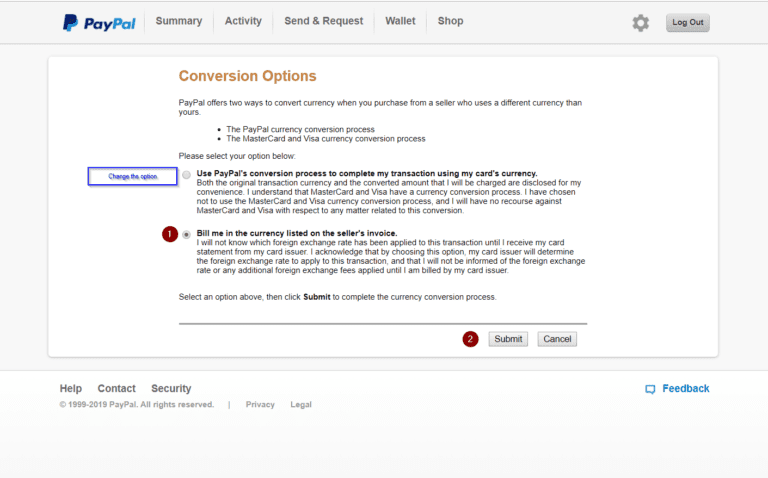

Disable PayPal’s Currency Conversion to save money on fees.

This method will allow you to choose the Mastercard/Visa currency transaction process over the PayPal one. In this case, your bank will manage the fees and you won’t be able to see the real cost until you will have received the statement from your card issuer.

A piece of advice: Use this method ONLY if you are sure that your bank offers smaller fees than PayPal.

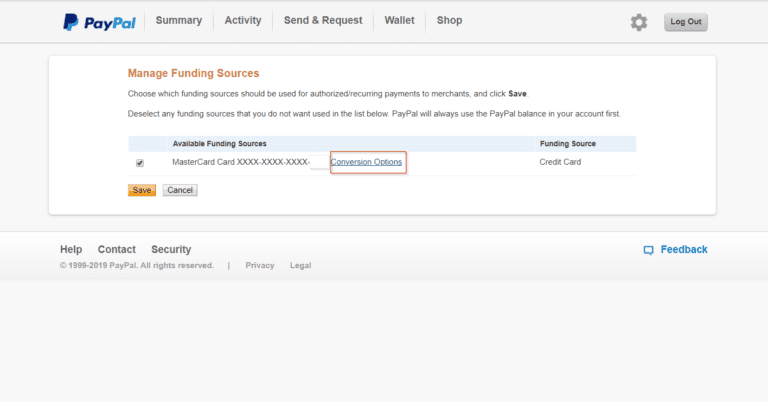

Here are the steps to manage your currency conversion options in your PayPal account. As a remark, PayPal is updating the interface all the time. So if you want to disable the currency conversion, you should address to PayPal’s Support for assistance.

- Log into your PayPal account;

- Go to this URL: https://www.paypal.com/cgi-bin/webscr?cmd=_profile-merchant-pull-funding ;

- Manage Funding Sources -> Conversion Options;

- Bill me in the currency listed on the seller’s invoice -> Submit.

Request a PayPal card (PayPal Business Debit Mastercard or PAYPAL CASH MASTERCARD)

By having these cards, you are able to access your PayPal money right away. You benefit from free transfers from the PayPal balance to your card.

As a result, you can choose to withdraw from any ATM up to 400 USD/month. There is also a standard daily limit for purchases of 3,000 USD.

PayPal Debit Mastercard provides 1% cash back on the net amount of your eligible purchases made during each calendar month.

However, having these cards involves some significant costs such as: 4.95 usd monthly fee, ATM Domestic and International Withdrawal Fees, Foreign Transaction Fees, Over the Counter Withdrawal Fee.

Here you can have a detailed look over the Terms and Conditions: PayPal Business Debit Mastercard and PAYPAL CASH MASTERCARD.

We recommend you the PayPal card only if you do not have other options. But overall, you should take into consideration the costs you are about to have in comparison to Revolut, TransferWise or other similar services.

If you are a business, opt to be paid less often.

You won’t get rid of the currency exchange fees, but the fix commission will be lower. Of course, the saving will not be much, but, hey…there will be money in your pocket.

Final words

Sticking to the end, you found out that you have some options to cut off the fees you are paying when using PayPal. For sure, there are alternatives in the market.

We explained the methods we successfully use for saving our money when buying online or transferring money.

In our opinion, when dealing with PayPal, our favorite provider is Revolut. Because it does not only allows us to integrate it costs free into PayPal, but it also fits to our daily financial needs (especially when it comes to travel).

On the other hand, we keep TransferWise as the second option for the low and transparent costs when transferring money or getting paid.

It is easy to understand why PayPal stands last in our ranking.

But as we mentioned, PayPal will continue to be one of the most popular payment gates in the world. Therefore, we hope our blogpost will help you make the best decision and avoid any the unnecessary costs.

As always, we are curious to see your feedback. So if you have any questions, recommendations of other services you successfully use, let us know.

PS: Last but not least…Big thanks to Ivana and Jamie, the two amazing guys behind @wanderintwo, for the inspiration and support.

If you find these advice useful, use the share buttons to spread our blog post with your friends on your social media platform.

Keep smiling! 😊

Amazing! So informative and easy to read! Incredible job guys well done

Thank you so much, Jamie. This means a lot coming from you. Saving money and avoiding fees is something everyone deals with, so we hope this article will help people secure their money. Since almost everyone uses PayPal, avoiding PayPal fees is such a great deal.

The MOST detailed and awesome blog post I’ve ever read about saving money from PayPal! I searched for this long time back but found nothing (especially for my country!). What I found was that it was JUST NOT POSSIBLE to do this if I’m living in my country. Haha… THANKS guys 🙂

So happy to share this with you and everyone else who might need it. We also searched for this solution and we were so happy when we found the way to save money when using PayPal for our online purchases. So we could not keep it for ourselves. Stay tuned, cause we are going to share some other cool tips for the future. Thank you for your Feedback!